Intel interested in buying ex-AMD fab and Ryzen chip maker, GlobalFoundries

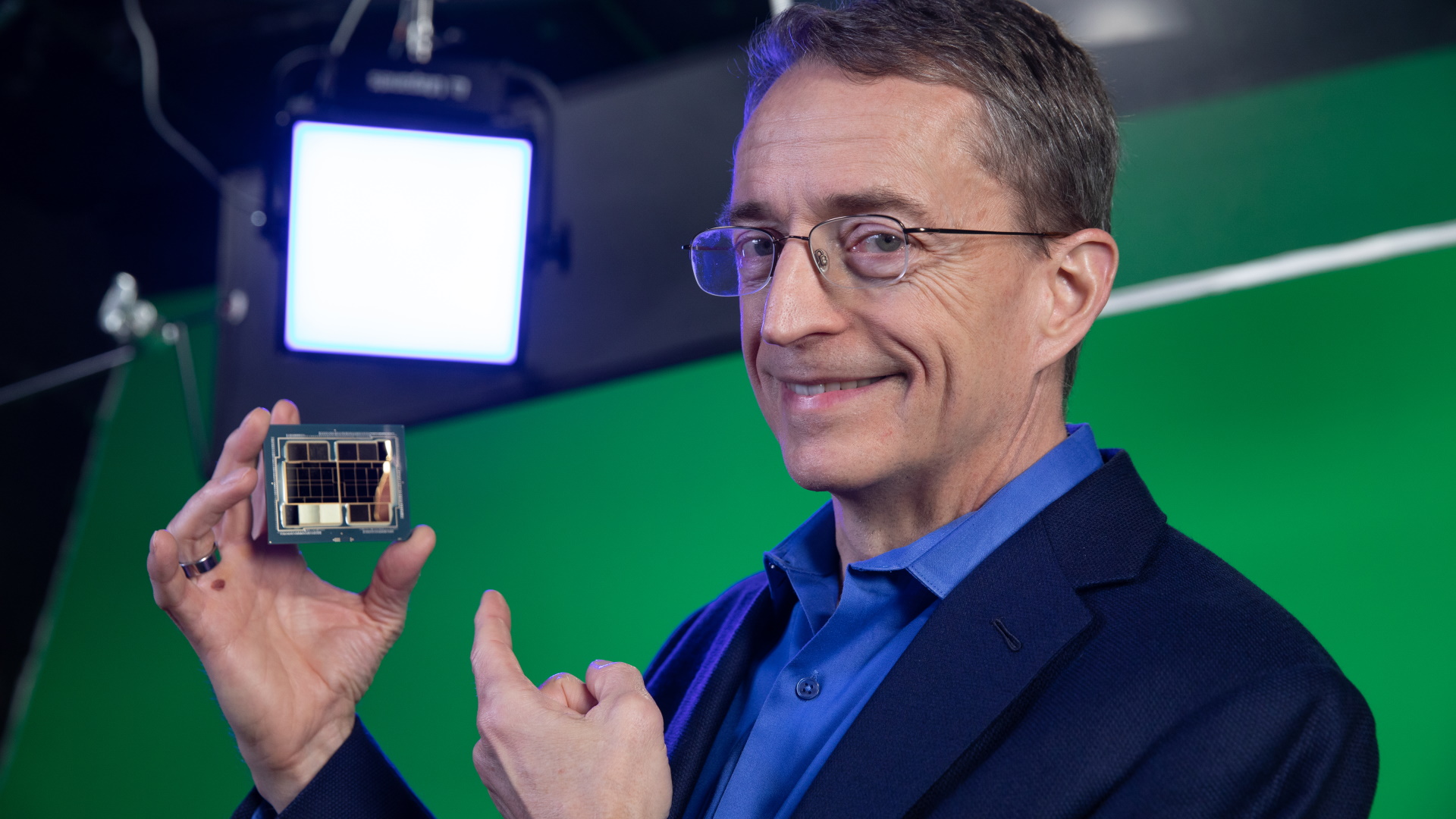

Intel's new CEO, Pat Gelsinger, has been making the rounds in Europe to talk about Intel's manufacturing plans, even speaking with French president Macron and Italian PM Mario Draghi about spending big in the EU. Yet there may be other deals afoot for the x86 chip maker, as reports suggest Intel could be eyeing up the once manufacturing arm of AMD turned "speciality foundry", GlobalFoundries.

According to people familiar with the matter, speaking to the Wall Street Journal, Intel is exploring the possibility of a deal to purchase GlobalFoundries for a grand sum of $30B in a bid to expand its manufacturing capabilities across the globe.

GlobalFoundries operates six chipmaking fabs, four 300mm and two 200mm, and its most cutting-edge process node is the 14/12nm process. That's a touch behind TSMC, Samsung, and Intel, all of which are developing processes at 7nm or beyond.

GlobalFoundries was once actively developing a 7nm process node to compete at the bleeding edge with these companies but decided to cease further development in 2018.

Now this is where things get interesting. Intel could, potentially, purchase a chip making company that is responsible for production of processors used with AMD Ryzen chips.

To better understand the series of events that may lead up to this, you have to first know about GlobalFoundries genuinely fascinating history.

GlobalFoundries was first spun out into its own company following a deal between AMD and an investment firm linked to the crown prince of Abu Dhabi to buy the former's manufacturing arm. AMD was struggling at the time, thanks to pressure from Intel no less, and its CEO had decided that a fabless approach would save it heaps of money in the long-run and deliver a sudden influx of much needed cash into the business right away.

According to AMD's CEO at the time, Hector Ruiz, that deal only came together through a dinner with Formula One team Ferrari. But that's a story for another time.

Important thing is, GlobalFoundries exists, AMD goes fabless from there on, and both companies sign a Wafer Supply Agreement (WSA) to ensure a harmonious supplier/customer relationship for years to come.

Practically, the deal tied AMD into buying most of its chips from GlobalFoundries and would be dissuaded through various means to procuring chips from elsewhere. Cut ahead to GlobalFoundries decision to halt 7nm process node development, and that WSA begins to unravel.

One major amendment to the WSA allowed AMD to procure chips from other foundries for 7nm and beyond, but kept the red team leased to GlobalFoundries for 12/14nm and larger nodes.

Then, earlier this year, AMD was freed of even this obligation. AMD can now procure chips from other foundries as it so wishes, although a key stipulation in the WSA says it must purchase at least $1.6B worth of chips from the fab by 2024 or else incur a fine, payable to GlobalFoundries.

Best CPU for gaming: the top chips from Intel and AMD

Best graphics card: your perfect pixel-pusher awaits

Best SSD for gaming: get into the game ahead of the rest

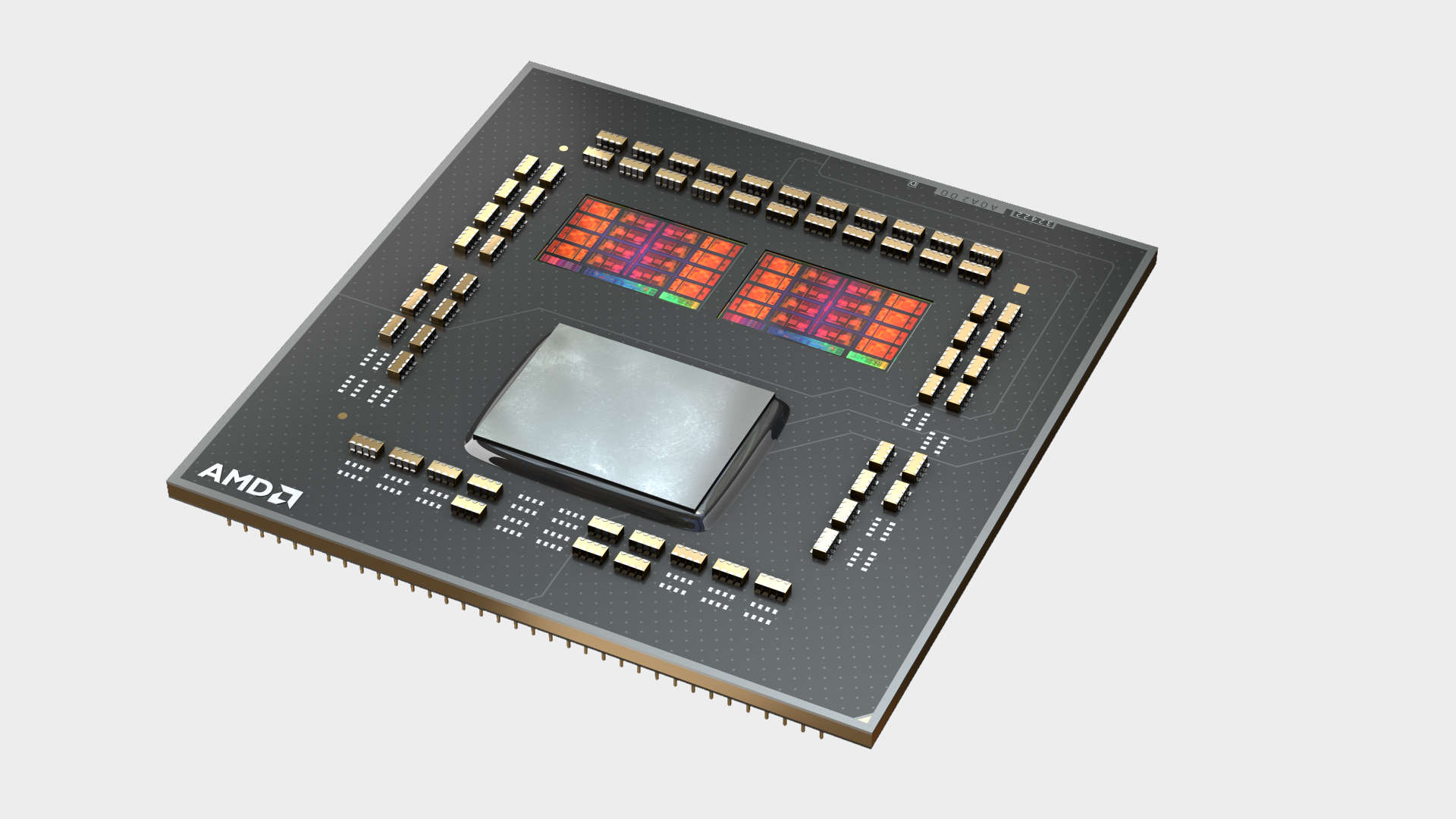

That's a lot of chips, but AMD does currently use one GlobalFoundries made chiplet in every Zen 2 or newer processor it makes. The processing core, or CCD, of AMD's Ryzen and Epyc processors are made by TSMC on the 7nm process, but the I/O die, or cIOD, is still to this day manufactured by GlobalFoundries.

So, long story short, if Intel could net a deal to purchase GlobalFoundries, it would be responsible for the WSA that AMD is indebted to. However, it must be said that corporate deals take years to finalise, so even if Intel were to purchase GlobalFoundries, which is anything but a certainty, it probably wouldn't have long left on AMD's WSA contract, which effectively ends all obligations to GlobalFoundries by 2024.

So if not to get AMD in Intel's pocket, why might Gelsinger be keen to purchase GlobalFoundries?

Contract manufacturing.

Intel currently produces its own CPUs with its own fabs (mostly, anyways). However, the company aims to go head-to-head with the world's biggest chip manufacturers in the world, TSMC and Samsung, with its own foundry contract business. This dramatic shake-up would see it taking on deals to produce chips for other companies, instead of just its own.

But Intel needs even more fabs to do that, hence the push into the EU and further investment into its global fab network.

Just one problem: "It just takes a couple of years to build capacity," as Gelsinger said back in May.

One way of expanding capacity without building them yourself is to buy someone else's fabs, and GlobalFoundries sure looks a prime candidate for just that.

Post a Comment