AMD confirms RDNA 3 GPUs this year and is spending big to 'to satisfy the demand out there'

AMD is on a real tear at the moment—and has been for the last couple of years, really—but it's also been beavering away in the background to make sure that it's able support its exponential growth with enough silicon to actually satisfy demand. That, at least, is the laudable goal for Dr. Lisa Su and Co.

The company has just turned in its 2021 financials, listing a 68% rise in overall revenue compared to 2020, which includes double-digit percentage growth in terms of both GPUs shipped and revenue. Someone's getting hold of AMD graphics cards, then, and the company is looking to keep that going because Dr. Su is still feeling "underrepresented in the business" of GPUs.

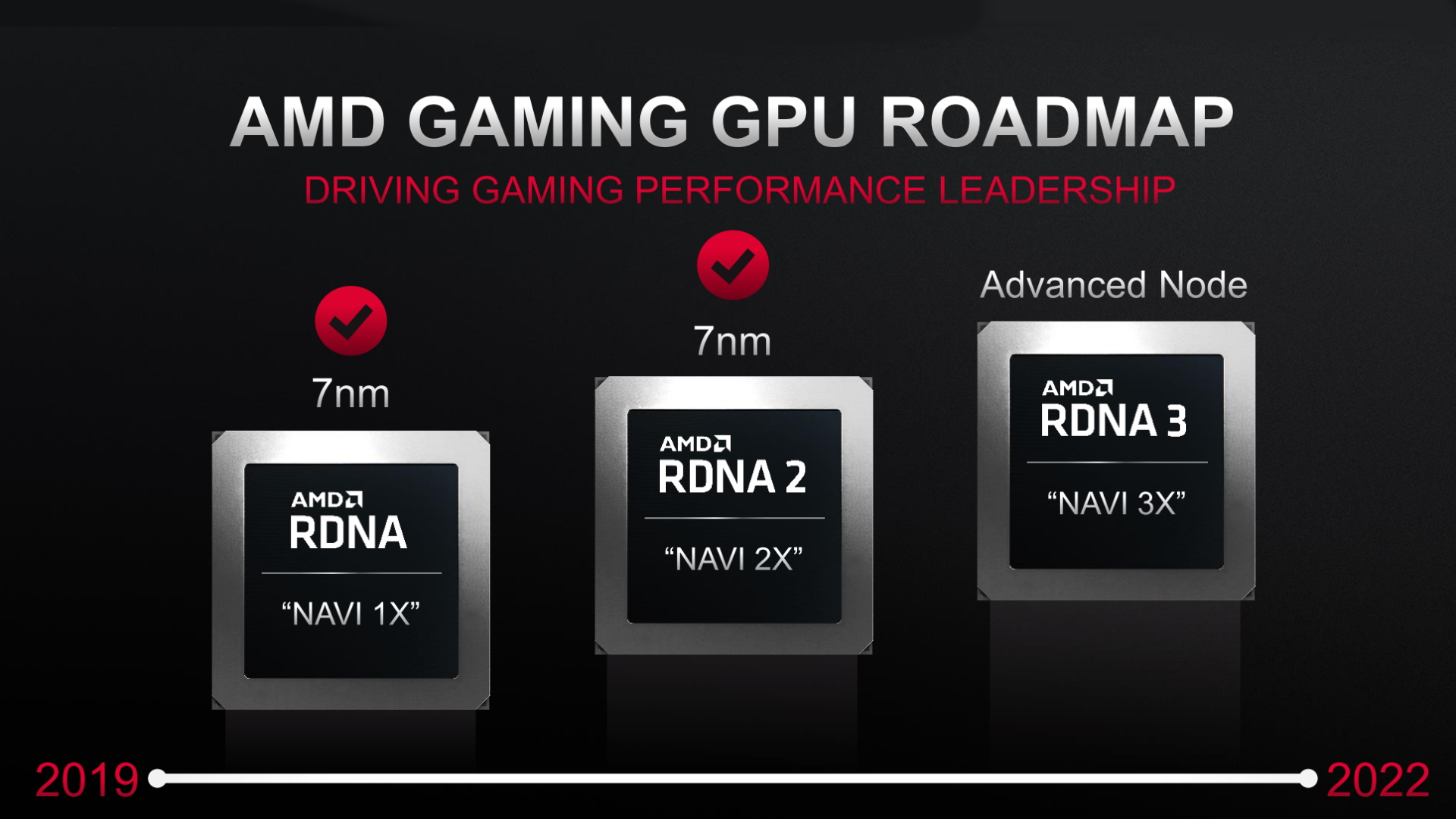

And with the ongoing chip shortage still blighting the industry, any hoped-for growth in AMD's graphics card market share is going to be stunted if it can't actually create enough Radeon silicon to fill the demand for its GPUs. That will be a serious concern if the next-gen RDNA 3 graphics cards, once again confirmed for release this year, improve upon the already excellent RX 6800 XT.

"Demand for our product is very strong," says Dr. Su in the recent earnings call, "and we look forward to another year of significant growth and share gains as we ramp our current products and launch our next wave of Zen 4 CPUs and RDNA 3 GPUs. We have also made significant investments to secure the capacity needed to support our growth in 2022 and beyond."

The industry hasn't just been struggling with getting chips out of TSMC—though that is always going to be some sort of a constraint—but other parts of the manufacturing chain have seen price increases and supply problems. That means AMD has to focus on shoring up the entire chain, not just squeezing more GPUs out of its foundry partner.

"We've been working on the supply chain really for the last four or five quarters," continues Dr. Su, "knowing the growth that we have from a product standpoint and the visibility that we have from customers. So in regards to [the] 2022 supply environment, we've made significant investments in wafer capacity, as well as substrate capacity and back-end capacity.

"We feel very good about our progress in the supply chain to meet the 2022 guidance. And our goal is, frankly, to have enough supply to satisfy the demand out there."

The demand for graphics cards is voracious, to say the least, so if AMD is able to find a way to sate that demand its market share is going to skyrocket. But there is always the concern that things may change in a market where the rogue state of cryptocurrency is operating. The continued rise in GPU-based cryptocurrency mining, principally using ethereum, has been one of the biggest contributors to the incredible demand for graphics cards, and that likely scares both AMD and Nvidia.

The last time crypto drove such demand the subsequent crash had a hefty blowblack for both the GPU makers, and left them with a lot of graphics cards floating around in a market that was no longer desperate for them. Mining had ceased to be profitable so the second-hand market was flooded, and that hurt. And it's obviously still in the back of their minds as the potential for the GPU mining of ethereum coming to an end in the near future grow ever more likely.

So, AMD is not just going to flood the market with chips blindly, which means you shouldn't expect to see retailers replete with every GPU under the sun. But you should start to actually see some available on a given day. And that is something we've started to see on the AMD side in recent times.

"We feel good about the progress we've made in PCs," says Dr. Su, "and we'll continue to ensure that we're matching sell in with sell out so that there is not inventory build up in the business."

Best gaming PC: the top pre-built machines from the pros

Best gaming laptop: perfect notebooks for mobile gaming

But don't expect the exorbitant pricing to get better with consistent stock levels, however. When it comes to pricing AMD says it's looking at the long-term picture and trying to share the increased costs throughout the supply chain, but a good part of why AMD's revenue has increased by such a large margin is because the average selling price of its GPUs has gone up.

Getting cards into market is more of a concern right now, rather than ensuring they're actually affordable.

"We're always in this for the long-term and working with our supply chain partners as well as our customers to ensure that we find a way to kind of share the additional costs," says Dr. Su. "But our focus is on ensuring that we have the supply to meet the high demand."

Post a Comment